Most couples think retirement will be a time to enjoy life and be happy: no more early mornings, overtime. It’s now time to travel, volunteer, and enjoy the grandkids. In fact, marriages can still end even with over half a million pounds in the bank if you’re not adhering to the rules guiding financial intimacy in retirement.

Susan was in tears over an argument about a £127 shopping bill. Not that she couldn’t afford it, she had £380,000 worth of savings with David. She was crying because, after 43 years of marriage, they were financial strangers living in the same home.

They needed clear rules for financial intimacy in retirement that could bring their hearts and their wallets back together again. “Everything was supposed to be so perfect,” she murmured to me in our consultation. “Except how to live with each other and with money.”

Wealth Doesn’t Guarantee Connection

Susan’s story is not an isolated one. Nearly half of wealthy couples experience emotional separation within the first two years after leaving work. They learned the way to make money, but not the rules that will make it the spur to true happiness.

The No. 1 predictor of a happily-ever retirement relationship is not net worth; it’s shared money rituals. Couples who discuss their finances weekly are 73 percent more satisfied than those who don’t.

I have discovered, after many years of coaching couples on retirement, that the happiest retirees aren’t the wealthiest. These are the ones who muscle their way to the top of the Financial Intimacy Scale by following the rules.

Rule #1: The Sunday Money Ritual that saves marriages

DON’T SAY: We need to discuss money more.

INSTEAD: Set a suitable time and day of the week for a brief conversation; this way, it becomes a habit.

The Marriage-Saving Script:

- What’s a money moment this week where you were proud of us?

- What is worrying you in silence about our finances?

- Where do we need better alignment next?

- What money habit would make life easier?

I enjoy spending my Sunday evening tapping into the “fresh start effect.” It is the moment my decision-making willpower is at its peak. Most couples reframe this as a date, as opposed to a meeting. Therefore, providing an opportunity to convert financial discussions into a bonding session.

Rule #2: The One-Page Dream Test

15 minutes to prevent years of resentment

Most conflicts arise when expectations about retirement do not align. You are not planning your one life; you are coordinating two.

The Life Alignment Grid:

Travel – Where, how often, and what budget?

Home – Should you stay, move, renovate, or downsize?

Daily Life – What about hobbies, routines, and personal space?

Legacy – What do we leave behind? Read our article on how to protect family wealth here.

And if alignment takes longer than 15 minutes, you’ve identified deeper disconnects worth exploring today.

Rule #3: Healing Financial Transparency

The 48-hour reconnection bootcamp

A third of retirees experience betrayal over financial secrets. Secret debts are typically between £5,000 and £15,000, and they can take months to recover from emotional hurt.

The 48-Hour Transparency Challenge:

First Hour: Log into all accounts as one unit

Second Hour: Say every debt aloud

Twenty-fourth Hour: Confess spending habits

Forty-eight Hour: Share your scariest money fears

The truth is that shame can’t sustain intimacy. But honesty keeps love strong.

Susan and David discovered £12,000 in hidden debt. In 48 hours, they developed a plan to pay it off. Six months later, the debt was cleared. They worked very hard to rebuild their trust, which became stronger than ever.

Rule #4: The Future Self Spending Test

Three questions that uncover hidden spending triggers

Every £1,000 spent in early retirement means months of freedom are stolen from your future 75-year-old self.

Pause before you buy anything over £200, and ask:

- Will our 75-year-old selves curse us or thank us?

- Is this a legitimate need or an emotional response (boredom, fear, ego)?

- If we only had six months to live, would this matter?

- This isn’t about restriction. It’s about understanding the thought process behind every financial decision.

Rule #5: Invisible Discipline

Automate your way to relationship peace.

When routine becomes invisible, what matters becomes crystal clear: dreams, conversations, connection.

Build Your Money on Autopilot:

- Bills paid automatically

- Savings transferred on pension day

- Investments scheduled monthly

- “Joy accounts” are funded for guilt-free spending

Manual money management drains energy that could be better spent building your best years together.

Rule #6: The Personality Peace Treaty

Respect each other’s money habits instead of arguing about them.

People’s money styles come from their upbringing and personality. You can’t change them overnight, but you can learn to work together.

The Treaty Terms:

Spender receives a guilt-free allowance, with no questions asked

The spender gets a set amount of money they can use however they want.

No judgment, no interrogation, just freedom to enjoy spending without guilt.

Saver receives: goals prioritized during saving with complete transparency

The saver gets reassurance that financial goals (like saving for a house or retirement) are being respected.

They also get complete visibility into where money is going, which helps them feel secure.

Both receive: Monthly “dream spending” sessions.

Once a month, both partners sit down and talk about what they’d love to spend money on, fun stuff, bucket list items, shared dreams.

It’s a way to bond and make sure money isn’t just about stress or sacrifice.

Peace isn’t about control. It’s about celebrating differences while you both work to build the same financial dream.

Rule 7: Love Letters to the Future

Real love means protecting each other, especially when life gets hard.

Planning for the future might not feel romantic, but it’s one of the kindest things you can do for your partner.

Love-Protection Checklist:

- Joint accounts that automatically transfer if one partner passes

- Wills that are up-to-date and reviewed every 5 years

- Legal powers to make financial and medical decisions for each other

- Shared access to essential passwords

- One honest talk a year: “If I died tomorrow, here’s what you’d need to know”

One day, one of you will be making decisions alone. This plan makes sure they’re not left in the dark.

Rule 8: Micro-Victory Celebrations

Celebrate small wins to build strong habits.

Little rewards can feel just as good as big ones, and they help you stay motivated.

Weekly win ideas:

- Cooked at home? Treat yourselves to a sweet dessert

- Stuck to your budget? Enjoy a peaceful sunset walk

- Made a smart money move? Crank up the music and dance for a minute

Discipline lasts longer when it feels fun, rather than being like punishment.

Rule 9: The Memory ROI Filter

Spend money on memories, not just stuff.

Studies show people regret buying things, but rarely regret experiences.

Before you buy, ask:

Will this create a lasting memory or take up space?

Smart memory investments:

- Weekend getaways

- Fun classes or hobbies

- Adventures with loved ones

- Family gatherings and celebrations

A sofa fades. A moment with your grandkids? That’s forever.

The Financial Intimacy Scale: Your Real Retirement Scorecard

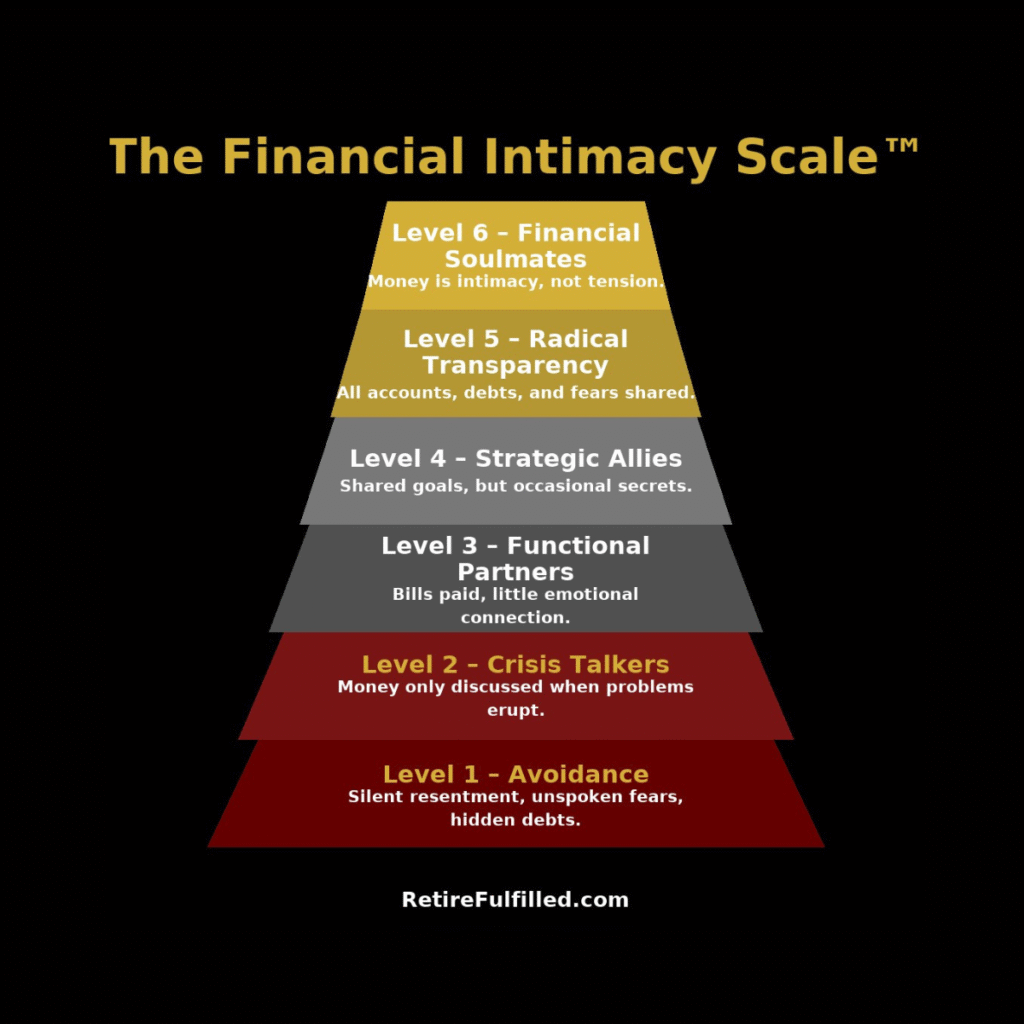

These nine money rules for couples in retirement aren’t only about money. They’re about climbing the Financial Intimacy Scale: the degree of trust, transparency, and teamwork you experience together.

Avoidance: Silent resentment, unspoken fears, secret debts

Crisis Talkers: Money is only discussed when problems erupt

Functional Partners: Bills paid, minimal emotional connection

Strategic Allies: Common goals, occasional secrets

Radical Transparency: All accounts, liabilities, and insecurities openly shared

Financial Soulmates: Money is no longer a source of tension, but intimacy

Why The Proven Financial Intimacy in Retirement Rules Transform Everything

When couples follow these strategies:

- Morning coffee becomes a sacred ritual, not a mindless routine

- Evenings shift from logistics to dreams and possibilities

- Holidays get planned with pure excitement, zero stress

- Grandchildren remember your presence, not your presents

Ignore these rules: Money quietly erodes your love until nothing remains.

Follow these rules: Discover your best years aren’t behind you, they’re gloriously ahead.

Financial Intimacy in Retirement: Your 7-Day Challenge

Don’t attempt all nine rules. Pick ONE. Commit seven days. Watch your relationship transform.

Text your partner right now: “I want to try something that could change our retirement. Are you in?”

Your 75-year-old selves will thank each other.

At RetireFulfilled, we inspire people to view retirement as a new chapter of freedom, purpose, and legacy, not as a slowdown. It’s about embracing life fully, together.

Retire smart, with love and fulfilled.