Table of Contents

- The Retirement Lie That’s Costing You Everything

- Why £500K Won’t Buy You Happiness

- The Three Lives Model

- The Real Formula: How Much Is Enough For Retirement in the UK

- Your Action Plan: Start Today (No Matter Your Age)

The Retirement Reality They Don’t Teach in Wealth Seminars

Thirty years or more of saving, and the retirement industry has sold you a lie wrapped in spreadsheets and compound interest calculators. The entire time you’ve been worrying about whether you need £500,000 or £800,000 to retire, you’ve been asking the wrong question. It’s not how much is enough for retirement in the UK; it’s why you’re planning for a kind of retirement that doesn’t exist anymore.

Every day, I meet people in their 60s who have million-pound pensions and yet feel lost, alone, and terrified. I meet others with modest savings who are living much happier, freer lives than they ever could have dreamed. They understood the retirement wealth equation that the financial services sector desperately wants you never to learn.

That option is the one that changes everything.

Financial planning is much like what retirement used to be a few decades ago. You set aside some money, hope for the best, and adjust when expectations don’t meet reality. It is trustworthy, predictable, and for the most part, tediously boring.

Alternatively, there’s holistic planning: constructing wealth across all dimensions, retirement as a life of impact and growth rather than just safety.

That first one is the one the financial industry is suggesting. It is easier, more beneficial, and allows them to spend less time explaining their expertise. But you aren’t planning for their pleasure; you’re planning for your life.

So, if you’re wondering how much is enough for retirement in the UK, keep reading. This might just be the truth you need to set you free.

Why £500K Won’t Buy You Happiness (But £200K Might)

Let me share two scenarios that will dramatically change how you view wealth in retirement:

Sarah, 66, with £1.2 million pension: Fully retired at the age of 65. Purchased a larger house, became a member of an expensive golf club, and flies in business class. Spends her days watching Netflix, shopping online, and fretting over changes in the stock market. She’s very lonely, has gained three stone, and says she’s never been more miserable.

David, 69, has a £180,000 pension. One day a week of consulting work keeps him on technical retirement status. He spends his free time volunteering for his daughter’s school, mentoring the next generation of entrepreneurs, and exploring local adventures of substance. His health, happiness, and personal relationships are better than anything he has ever experienced in a full-time job.

Why More Money Won’t Guarantee a Happy Retirement

Most people believe bigger savings mean a better retirement. Reality? Not always.

The Hidden Wealth Trap

Having plenty often tempts people to quit work entirely. Suddenly, they lose structure, purpose, and the daily interactions that gave life meaning. Many of them become lonely and restless, despite having plenty of money.

Oddly, it is some of those who have saved the least who feel forced to stay in part-time work. Without realising it, they remain socially connected and active, avoiding the biggest pitfall of retirement: isolation.

Sometimes, having fewer of something pushes people into healthier, happier decision-making. Money certainly helps, but purpose and people matter more.

The Purpose Vacuum

Wealth provides options, but choices without some sense of purpose can lead to emptiness and stagnation. The teacher, who has relatively modest savings and still gives tutoring to underprivileged children, has a greater sense of purpose than the multimillionaire executive who golfs round the clock.

The Flexibility Penalty

Ironically, “having enough” money often leads people to become inflexible. They’ve hit their number, so they stop adjusting. But people with tighter budgets remain flexible, resourceful, and open to change.

All of this is why how much is enough for retirement in the UK is a paradox: enough to avoid stress-related poverty, but not so much that you extinguish the need for ongoing growth, change, and service.

The Hidden Costs No One Talks About

You know how financial planners like to say you are going to need “70 percent of pre-retirement income?” This is wishful thinking that ignores reality:

Healthcare expenses are skyrocketing: Private health insurance is growing at a rate of 12.6% per year, and retiree health policies are significantly more expensive than standard coverage.

Household upkeep ramp-up: When you spend 24/7 at home, everything requires more attention and, in many cases, repair.

Social substitute costs: The gym membership becomes a must-have, socializing replaces office chat, and hobbies go from being weekend outings to daily needs.

The urgency factor: Travel becomes urgent when you start realizing that your active years are limited, resulting in travel budgets of between £ 5,000 and £10,000 per year.

The retirees I know who are living on less than 85% of their pre-retirement income are not saving money.

The Three Lives Model: What You’re Actually Saving For

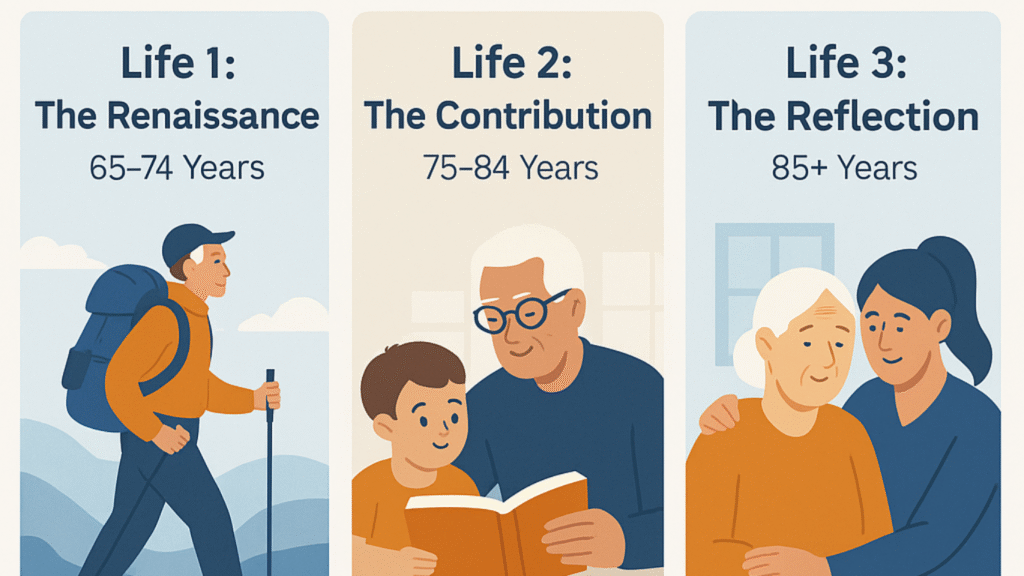

Put aside the old-fashioned notion of retirement planning. You’re not planning for retirement; you’re planning for three overlapping lives:

Life 1: The Renaissance (65 to 74 Years)

This is a phase that requires preparation. It’s the busiest and most expensive time, typically costing £35,000–£50,000 a year. Begin building this phase in your 50s, not your 60s. This is the time for reinvention, not rest. You still have energy, health, and the freedom to explore your passions, your chance to pursue dreams, start new ventures, and embark on extensive travels. Concentrating on things you are good at.

Life Two: The Contribution (75-84)

Energy is slowly diminishing, but wisdom increases. This is your giving-back phase: mentoring, grandparenting, community engagement, spreading knowledge. You want less money, but more social infrastructure. Those who struggle here are those who make it through Phase One but spend it in pure leisure, disconnected from everyone. This Phase tends to run between £25,000 and £35,000 a year.

It is at this point that comprehensive retirement planning is absolutely critical. The common advice of “save your money first, figure everything else out later” means most people are financially set, but not socially and emotionally ready for this life-changing part of their lives. You can’t build a true community overnight. You can’t build mentoring relationships after years of nurturing them. Nor are you going to become a treasured community member merely through the act of showing up with good intentions and a pot of pensions.

The happiest Phase Two retirees started building their networks in their 50s. They volunteered while working, nurtured multigenerational relationships, and gained expertise worth sharing. At age 75, they’re not looking for a new purpose; they aim to deepen the one that has defined their lives.

Life Three: The Reflection (85+)

Health restrictions increase, but for many, this can be life’s most meaningful period: time with family, spiritual inquiry, and legacy building. You have the least money but require the most support systems. In this phase, you spend between £20,000–£40,000 a year.

Different resources are required in each phase. Phase One involves money and experience. Two requires social capital to have any meaning. And phase three involves dignity care systems.

The Real Formula: How Much Is Enough for Retirement in the UK

Forget the outdated “multiply your expenses by 25” rule.

Here’s the calculation that actually works:

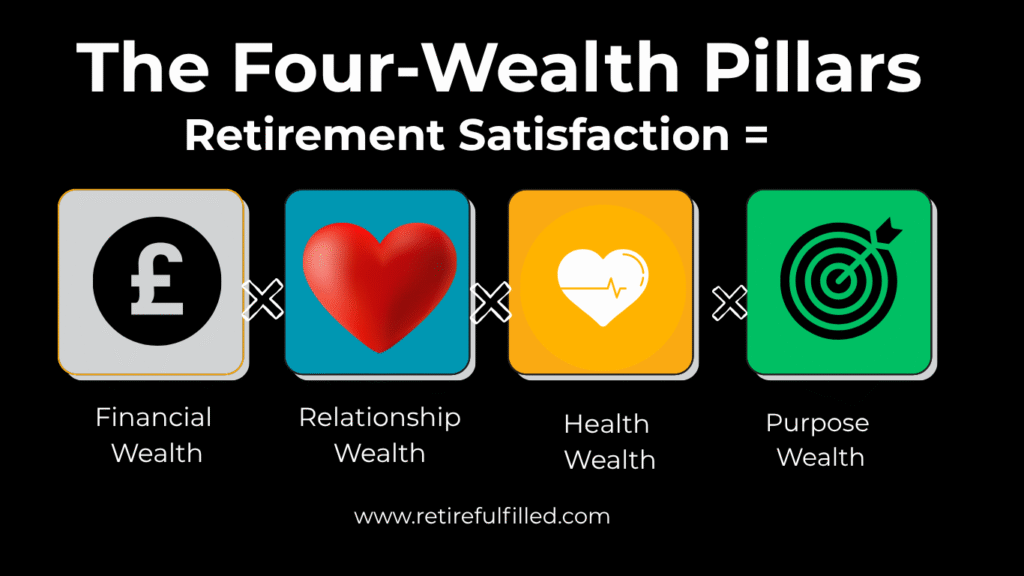

The Four-Wealth Formula

Your Retirement Readiness = Financial Wealth × Health Wealth × Relationship Wealth × Purpose Wealth

Notice that it’s multiplication, not addition. If one area is missing, the whole equation suffers because you’re not just funding a lifestyle, you’re financing your entire life.

This is why some millionaires can feel miserable, while some people with modest savings can thrive.

The Financial Wealth Calculation:

Renaissance Phase: £350,000-£500,000 (10 years × £35,000-£50,000)

Contribution Phase: £250,000-£350,000 (10 years × £25,000-£35,000)

Reflection Phase: £200,000-£400,000 (variable due to care needs)

Total Financial Need: £800,000-£1,250,000

But here’s the revolutionary part: the high non-financial wealth can reduce your financial needs by 40-60%.

The Wealth Multiplier Effect

Health Wealth (reduces healthcare costs, extends active years):

- Regular exercise that you actually enjoy

- Preventive healthcare beyond NHS basics

- Stress management and mental health support

- Investment: £2,000-£5,000 annually in your 50s and 60s

See Age UK’s guide on staying healthy in later life and NHS Live Well for fitness and mental wellbeing resources

Relationship Wealth (reduces isolation, provides support):

- Friendships beyond work relationships

- Community connections and engagement

- Family relationships and social networks

- Investment: Time and emotional energy (invaluable during physical decline)

Purpose Wealth (provides meaning, often generates income):

- Skills and expertise that transcend your career

- Interests developed over decades, not months

- Capacity for continued contribution and growth

- Investment: Lifelong learning and development

Real-World Impact

High-wealth retiree: needs less than £500,000 in financial wealth because health, relationships, and purpose multiply satisfaction and reduce costs.

Low wealth retiree: needs more than £1,200,000 financial wealth to make up for missing wealth types, and still not enjoy life.

That is why asking how much is enough for retirement UK without all four types gives you incomplete answers.

Building Wealth That Actually Works

The most successful UK retirees don’t “retire”, they “retire” into their most authentic lives. Here’s how they build real wealth across all dimensions:

Financial Wealth: Strategic Integration

Traditional approach: maximize savings, minimize current spending, hope compound interest solves everything

Integrated approach: balance future security with current life enrichment. the 50-year-old who invests in health, relationships, and skills might need less retirement savings than someone who sacrifices everything for maximum accumulation

Health Wealth: Your Highest-Return Investment

Physical foundation: exercise you genuinely enjoy, preventive healthcare beyond NHS basics, nutrition for energy and longevity

Mental optimization: stress management practices, professional support when needed, cognitive engagement through learning

ROI reality: £3000 invested annually in health during your 50s can save £30,000+ annually in healthcare costs during your 80s while dramatically improving quality of life

Relationship Wealth: Your Loneliness Insurance

- Career connections: maintain relationships based on respect, not just shared employment

- Community engagement: join organizations, volunteer, engage locally while you’re still working

- Cross-generational friendships: stay connected to different life phases and perspectives

Key insight: Approximately 50% of individuals aged 60 and older are at risk of social isolation. It is crucial to build connections early, as retirement cannot create a social infrastructure from scratch.

Purpose Wealth: What Gets You Up in the Morning

- Skills development: transform lifelong interests into expertise worth sharing

- Knowledge transfer: develop the capacity to mentor, teach, or guide others

- Contribution readiness: maintain psychological flexibility to engage meaningfully with new challenges

Examples: the craftsperson who teaches traditional skills, the executive who mentors young entrepreneurs, the professional who tutors disadvantaged students

Your Action Plan to Master How Much Is Enough for Retirement in the UK: Start Today (No Matter Your Age)

The Universal Strategy: Use the following framework before retirement:

Develop all four types of wealth simultaneously; your financial wealth is just one part of the picture.

Audit phase: Calculate wealth distribution in all four dimensions. What did I overdo, but what did I save? Go for it.

Integration phase: start building missing wealth in different ways. Do not expect to start living authentically and freely only after retirement.

Testing phase: Experience retirement habits before you make the move; spend short periods living in the lifestyle you envision for your retirement.

Transition phase: Stay engaged with others as you transition through careers. Reduce work or business hours while increasing activities

Age-Specific Priorities:

In your 40s: Build the Foundation

Foundation building across all wealth types. Aim for £200,000-£300,000 financial wealth by age 50.

If You’re in Your 50s: The Integration Phase

Integration intensifies. Continue the balance of continuing accumulation with current life enrichment. Aim for £400,000-£600,000 by age 60.

Your 60s: Transition Planning

Transition preparation. You probably have it all, but if you’ve built wealth across all dimensions, you have what you need. Focus on maximizing health and social engagement. Address the absent wealth types immediately.

Already Retired: Time for Optimization

If you’re struggling with money, money probably isn’t the problem; you’re missing one of the other types of wealth.

So tackle isolation early: Loneliness is as deadly as smoking. Give social connections priority over financials.

Be flexible: Your retirement will evolve. Adopt changes instead of resisting them.

Your Weekly Check-In: Staying on Track to Have Enough for Retirement in the UK

Every week, ask yourself:

Financial: Am I balancing security with fulfilment?

Health: What did I do this week to invest in my long-term health?

Relationships: Did I foster relationships that will be important in retirement?

Purpose: Am I learning about things and skills that I may find meaningful later?

Ready to Revolutionize Your Retirement?

Stop planning for retirement; start planning for life.” The Four-Wealth Assessment will show you what you truly have and what you truly need to create. It’s not just another financial calculator; it’s a life readiness assessment.

As the ultimate truth about retirement wealth, you don’t need millions to retire comfortably. To retire well, you need wisdom.

And that journey begins when you stop asking, “How much is enough?” and start asking, “Enough for what?”

Now available to download: the Four-Wealth Assessment and discover how much is enough for retirement in the UK. The real answer: Enough to live, love, and grow for life.

This guide contains general information and shouldn’t replace personalized financial advice. Consult qualified professionals for decisions specific to your situation.