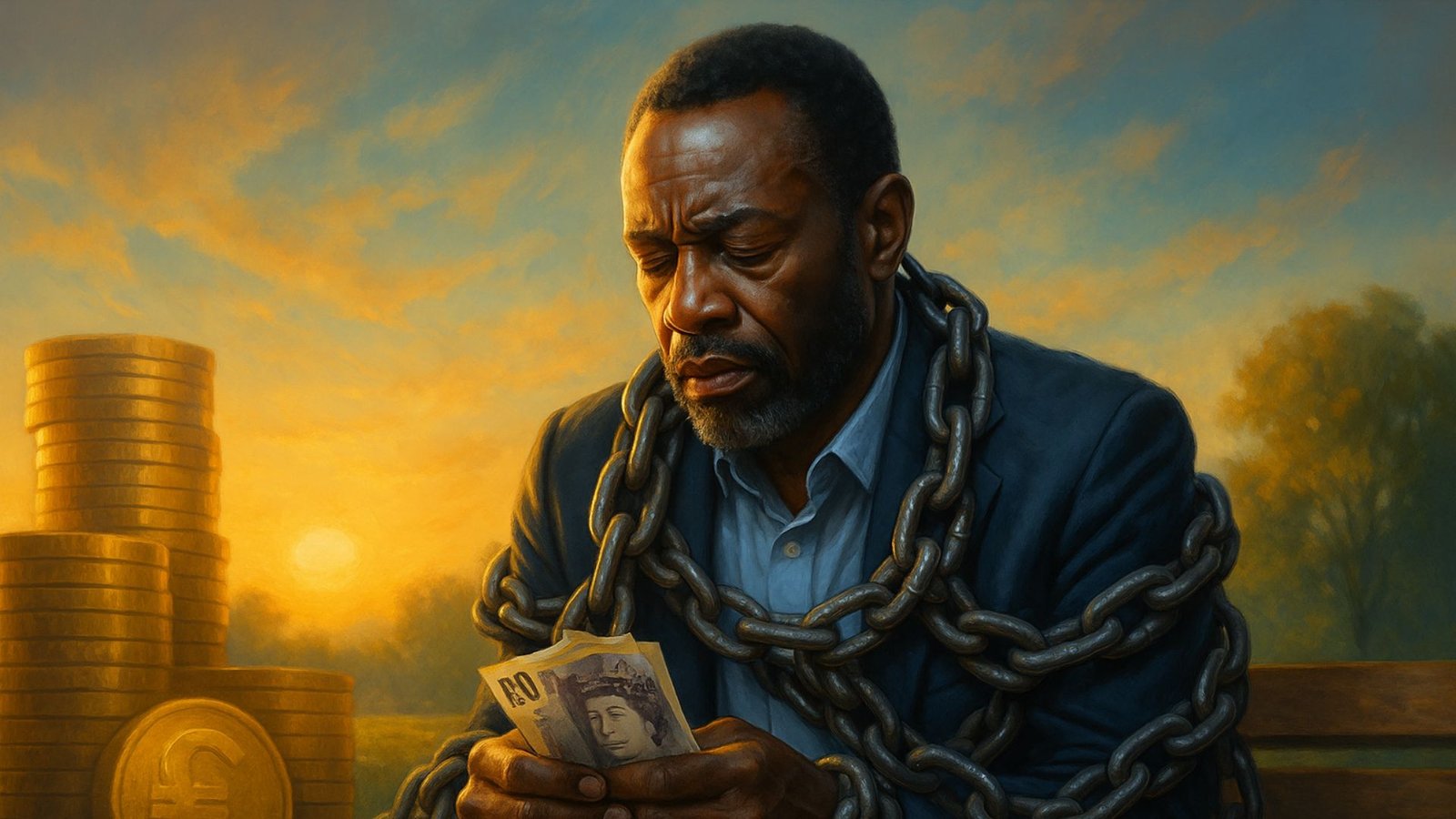

You have done everything right, saved for the future, made sure you will be all set, and earned your freedom. Still, at this point, you second-guess purchasing small things, need an excuse as to why you want it, and sometimes feel guilty for even chilling. Your spreadsheets say you’re fine… but your body still feels ready to crash. But really, it’s not about how you handle money anymore; it’s the poverty mindset in retirement.

Those old stories in your head that haven’t caught up. The ones that whisper things like:

“Let me just double-check the numbers real quick….”

“What if something goes wrong?”

“Maybe I should wait a bit.”

And you’re not alone. Many retirees feel anxious about money, and nearly 70% with savings still share this feeling. So, no, you’re not doing anything wrong. You’re simply carrying the weight of long-held fears.

The irony is that you are the most financially secure you’ve ever been, but it still feels hard to enjoy it.

The Stories We Carry

This mindset isn’t something you chose; it was passed down, generation after generation, like an unwanted family keepsake. It wasn’t just about being responsible with finances; we heard in those early messages: “It’s outside our financial reach for now.” They were subtly connecting wires in your brain:

Spend = Risk,

Rest = Guilt,

Joy = Shame

In The Psychology of Money, Morgan Housel describes how our interaction with money is 90% emotional and only 10% logical. And when you get a little more in your bank account, those old scripts don’t simply vanish.

It might seem like financial doom is just over the horizon, even when you have a retirement account funded and your home mortgage is paid off. You’ve retired from your job, yet you continue to punch the clock for fears you don’t even identify.

Read further article on How our perception of wealth shapes our sense of purpose and happiness here.

7 Signs You’re Still Operating With a Poverty Mindset in Retirement

- Your generosity has limits that feel tight. You are all about putting your family first, until a family member requests $5,000 and you lose it.

- Praise for frugality hits deep. Being told you live modestly reassures you. It’s not just a compliment; it’s a safety signal.

- You protect more than you enjoy. Your energy is invested in keeping that money, not enjoying life.

- Planning for emergencies feels like a full-time job. Your emergency fund has an emergency fund, and it feels risky to dip into your savings

- Joy feels like a guilty pleasure. That luxury holiday or personal treat still feels excessive, even if your finances are stable and your essentials are well-covered.

- You feel like you have to earn rest. Downtime only feels “deserved” after effort. If you’re not busy, guilt creeps in and you find something to do.

- Freedom feels more theoretical than real. Your accounts say you’re secure, but you still wake up with that old ‘better be careful’ mindset.

This isn’t careful stewardship, it’s fear dressed up in financial responsibility.

The Hidden Costs in Your Retirement Years

While you’re busy protecting your wealth, this poverty mindset in retirement is creeping in as it silently takes from you:

Your Peace: The assurance that you paid for turns into a recurring concern.

Relationships: Conversations about money often carry a lot of emotional weight, usually negatively. You tend to withdraw instead of opening up to connect with your partner.

Legacy: Without proper purpose, resources are not a blessing…they become a burden instead.

Time: Indecision and procrastination as life passes by.

It’s not the retirement story you wrote during those working years.

Rewiring Your Financial Operating System

Moving from scarcity to sufficiency isn’t about spending more; it’s about shifting your mindset. A poverty mindset in retirement often works unconsciously, which is why breaking free requires intentionally rewiring your emotional responses to money.

1. Shift Your Perspective

Transitioning from a scarcity mindset to one of sufficiency isn’t about reckless spending; it’s about trusting that what you have is enough. Begin by identifying those ingrained thought patterns that shape your financial habits and intentionally choose new, empowering beliefs.

2. Challenge the Familiar Voices

When anxious thoughts about money arise, ask yourself: “Where is this coming from?” Could it be a parent’s warning, cultural conditioning, or an outdated personal story? Consider whether this fear still helps you or if it’s just a lingering echo.

3. Change the Questions You Ask

Swap fear-based questions for ones rooted in presence and purpose:

- Instead of: “What if I run out?” Try: “What if I never get to truly taste the fruits of my labour?”

- Instead of: “Can I afford this?” Try: “Does this choice reflect my values and the life I’m building?”

This isn’t denial, it’s thoughtful decision-making.

Read our article on How to Simplify Your Finances After 50 and Stay in Control Before Retirement.

4. Revisit Your Financial Origin Story

Trace your earliest memories around money. What stress did you witness? What beliefs took root? Respond to those past moments with the wisdom you have today:

- Then: “We can’t afford that.”

- Now: “I have options my younger self would never have imagined.” You are not dismissing your past, you are reframing the story with wisdom.

5. Clarify Your Financial Priorities

What does money mean to you? Adventure, stability, generosity, creativity? Find your core values and allow them to determine your decisions. When money aligns with purpose, it becomes a tool for fulfilment, not just a means of survival.

6. Spend with Intention

Make a values-based purchase that brings joy without guilt. Notice the initial discomfort, then observe how nothing bad happens. This is how you begin rewiring your emotional response and reclaim confidence in your spending.

7. Step into Financial Sovereignty

You didn’t work hard just to live in fear. Let your financial stability support a life full of purpose. True freedom occurs when you trust your choices, lead with your values, and stop second-guessing every decision.

Take on the challenge this Week: Be Free to Flourish

Understanding a thing and allowing it to change you are two very different things. Just this week, push one thing over that line and give yourself the financial freedom to focus on your mental or physical health.

Buy something that serves no purpose other than bringing you joy, perhaps a pampering product or ingredient. Not out of necessity, but because it reflects who you are becoming this season of your life. Pick something you’ve been putting off (not because of money, but because of emotional hesitation).

Or perhaps that gourmet meal you were saving for “the perfect time.” Except, maybe, the upgrade that you persuaded yourself to pass up. It could be the handcrafted piece that brought happiness but seemed frivolous.

Price tag is not the key. But it is what that decision means.

Permission granted:

- To believe in the financial of enough

- Act like someone who has had enough

Disclaim that unspent wealth represents wise forbearance because it can be a quieter form of desire.

As you make this purchase, take note of:

What narratives surface? Or for that matter, whose voices do you hear?

- Does it feel weird to be coming from abundance, not fear?

- What does that do to your sense of security later on?

In the end, living with a poverty mindset in retirement is more than just a problem with your bank account; it’s about permitting yourself to truly start enjoying the life you’ve mostly earned.

Your Liberation Starts Now

Recognition is the first step toward freedom. If this sounds familiar, you’re likely dismantling generational issues that weren’t yours to begin with.

Take Action Today:

Journal This Tonight:

“If I truly believed I had enough, what would I allow myself to experience this month?”

Your retirement isn’t just a dress rehearsal; it’s the main performance you’ve spent your entire working life.

Are you ready to rewrite your relationship with money and retirement? Join our community learning to live fulfilled, not just financially secure. Your wealth was meant to serve your life, not the other way around.